By Eva Wilson

Inflation Reduction Act Series: Part D Redesign Program

The Inflation Reduction Act, signed into law in August 2022, represents one of the most expansive federal investments in energy, climate, and healthcare policy in decades. Among its healthcare provisions, the law’s reforms to Medicare Part D aim to protect beneficiaries by capping annual out-of-pocket (OOP) prescription drug costs, while simultaneously reducing the federal government’s reinsurance liability and introducing a new cost-sharing framework that places greater financial responsibility on pharmaceutical manufacturers and Medicare Part D plan sponsors.

This shift is significant because it not only enhances affordability for patients but also redefines the relationships between manufacturers, insurers, and the federal government. The redesign introduces the Manufacturer Discount Program (MDP), which replaces the long-standing Coverage Gap Discount Program (CGDP), and expands manufacturer discount obligations into both the Initial Coverage and Catastrophic phases, a significant shift from the previous system where manufacturer’s liability was limited to the coverage gap alone.

The implications of these changes are far-reaching. Pharmaceutical manufacturers will face earlier and broader financial liabilities, compelling them to reassess pricing strategies, gross-to-net forecasting, and operational readiness. Additionally, with more than 52 million Americans currently enrolled in a Part D, these changes are set up to significantly reshape the pharmaceutical ecosystem1.

In our third white paper series on the IRA, we offer a comprehensive examination of the Part D Redesign, beginning with a breakdown of the policy changes, followed by an analysis of their operational and financial implications for drug manufacturers. It will also explore the strategic considerations companies must address to remain compliant and competitive in the post-IRA landscape.

The New Improved Medicare Part D

Medicare Part D (also known as Medicare Drug Coverage) is the portion of the Medicare program that helps beneficiaries pay for both brand-name and generic prescription medications. Coverage is administered through private insurance companies that contract with the federal government, and while formularies and premiums can vary, nearly all plans cover a broad range of essential outpatient drugs.

Part D has a significant financial footprint on Medicare. In 2022 Medicare spent $102 billion on the program, an increase from $95 billion in the previous year1. With nearly 4.3 million enrollees reaching the catastrophic phase in 20221, and with the rising costs of prescription drugs, Medicare members were left with facing affordability challenges, particularly those managing chronic illnesses with multiple prescriptions.

To address these financial pressures, the federal government enacted a redesign of Medicare Part D under the IRA. The core objectives of the redesign include:

- Lowering Out-of-Pocket (OOP) Costs: Introducing a $2,000 annual cap in 2025 (increasing slightly to $2,100 in 2026), significantly reducing the financial burden on patients.

- Improving Access: Applying manufacturer discounts to individuals in the low-income subsidy program (LIS) and expanding the LIS eligibility from 135% to 150% of the federal poverty level.

- Redistributing Financial Responsibility: Shifting liability from patients to manufacturers and plan sponsors, particularly in the initial and catastrophic phases of coverage.

While these changes are designed to improve patient affordability, they also introduce complex financial and operational consequences for pharmaceutical manufacturers, requiring urgent readiness.

Sharing Costs or Barely Sharing?

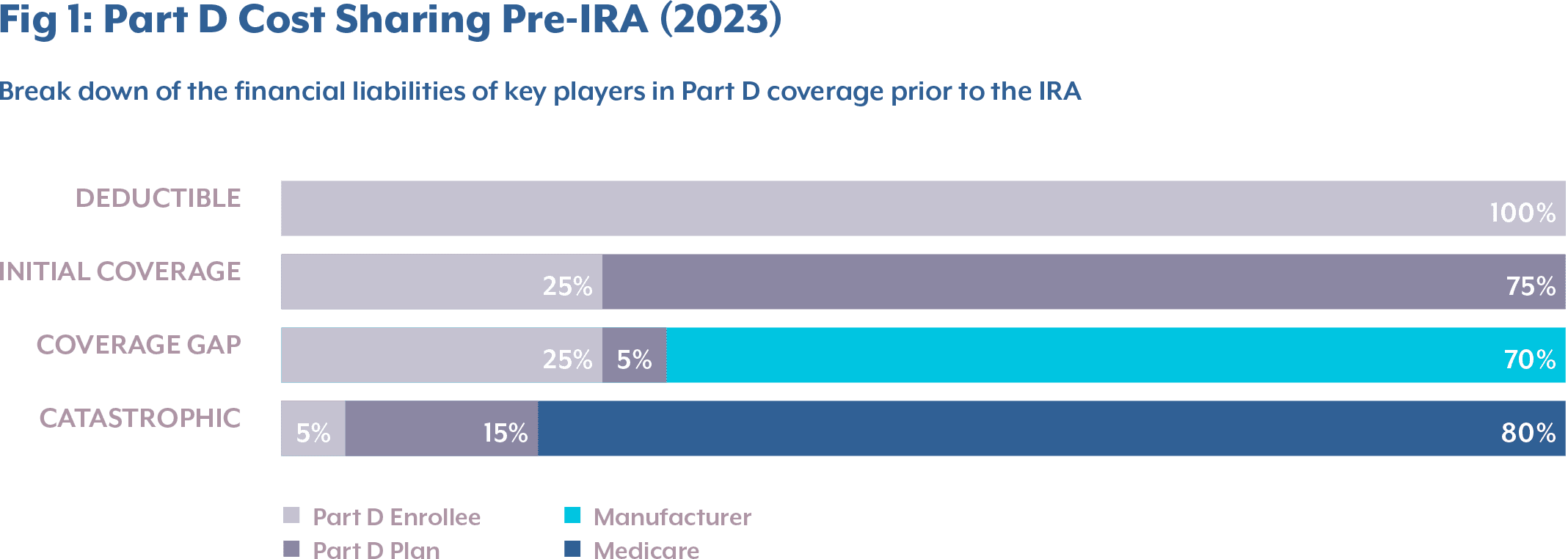

Prior to the IRA, the typical design of Medicare Part D (for non–low-income subsidies) had four phases, where each phase had a varying share of drug costs paid by the Part D enrollee, the Part D plan, and Medicare.

- Deductible Phase: Part D enrollees paid 100% of the drug costs up to $505.

- Initial Coverage Phase: Part D enrollees paid 25% of total drug costs, while the Part D plan paid 75%, up to $4,660 in total drug costs. At this point, a beneficiary would have paid the $505 deductible plus an additional $1,038.75 in coinsurance, amounting to a total true out-of-pocket (TrOOP) spending of $1,543.753.

- Coverage Gap Phase: After surpassing the initial threshold, the beneficiary entered the coverage gap or “donut hole,” remaining there until TrOOP reached $7,400 or the total drug costs reached $11,206. In this phase, manufacturers’ financial liability began, covering 70% of the total drug costs3.

- Catastrophic Phase: Once TrOOP reached $7,400, Medicare paid 80% of drug costs, the Part D plan paid 15%, and enrollees were responsible for the remaining 5% coinsurance3.

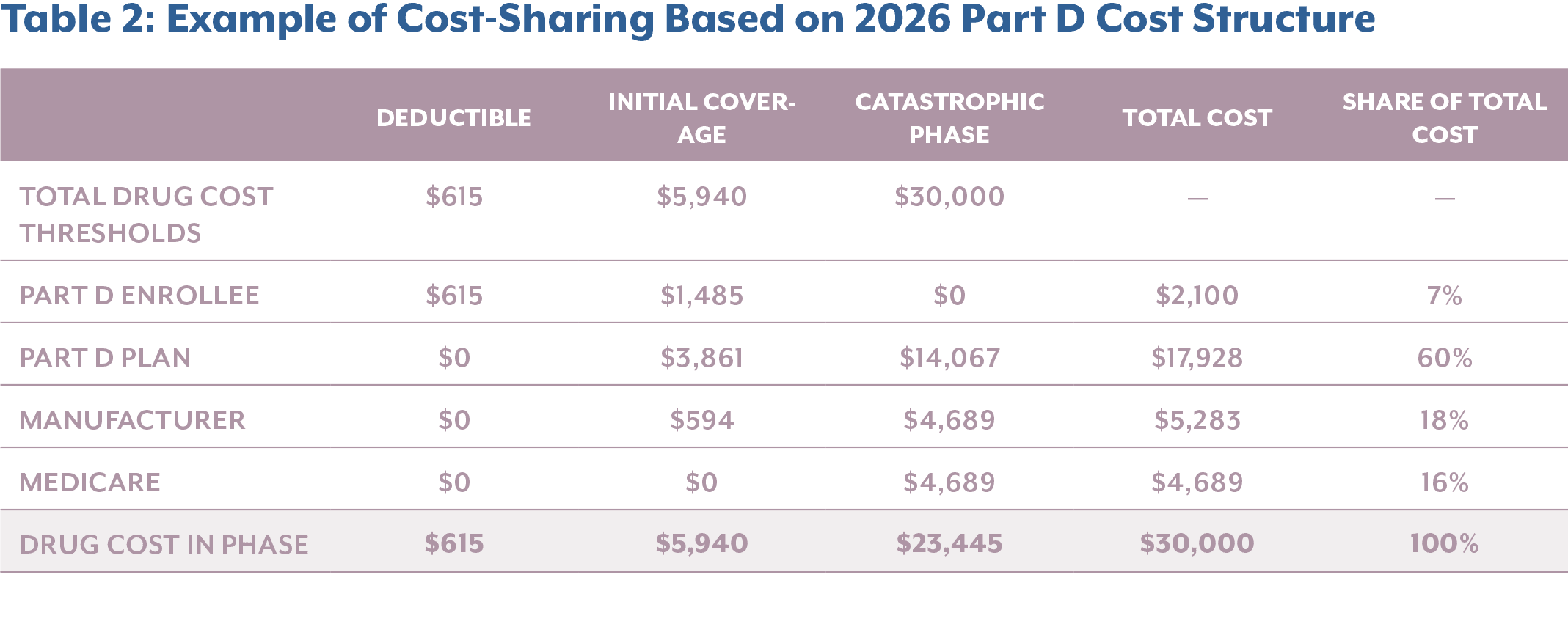

The instructions of the Part D Redesign Program for 2026 calendar year (CY), defines the standard for the Part D benefit, including

- Annual Deductible: The enrollee pays 100% of their gross covered prescription drug costs (GCPDC) until they reach the deductible of $615 for CY 2026 – up $25 from 2025.

- Initial Coverage Phase: The enrollee pays 25% coinsurance for covered Part D drugs. The Part D plan pays 65% of the cost of applicable and selected drugs and 75% of all other covered Part D drugs. Through the Manufacturer Discount Program (MDP), manufacturers cover 10% of applicable drugs. CMS pays a 10% subsidy for selected drugs during the price applicability period. This phase ends when the enrollee’s annual out-of-pocket costs reach $2,100 (a $100 increase from CY 2025).

- Catastrophic Phase: The enrollee pays no cost-sharing for covered Part D drugs, whereas the Part D plan pays 60% of costs and manufacturers pay a 20% discount on applicable drugs. CMS covers a 20% reinsurance subsidy on applicable drugs and 40% of costs for all other covered Part D drugs that are not classified as applicable, including select drugs during the price applicability period.

The newly established MDP replaces the previous Coverage Gap Discount Program (CGDP) in the Coverage Phase. Whereas the CGDP provided a 70% discount to Part D enrollees in the coverage gap phase, the MDP requires participating manufactures to provide 10% and 20% discounts during the initial and catastrophic phases, respectively.

Financial Implication for Pharmaceutical Industry

While the shift from a 70% discount to a combined 20% and 10% manufacturer liability under the IRA may initially seem counterintuitive, especially given its goal of increasing manufacturer responsibility, the financial forecasts from several pharmaceutical companies suggest that the policy is, in fact, achieving its intended impact.

Pfizer, for example, has projected a $1 billion revenue loss as a direct result of the new Part D structure. The company identified eight drugs most affected by the redesign, which together generated $19 billion in revenue in 2024. Amongst the eight, Pfizer expects the higher-priced drugs in specialty and oncology care to be more heavily impacted including Ibrance, Xtandi, Vyndquel and Xeljanz5. With the IRA reforms in place, CMS and beneficiaries are set to realize significant savings, but these come at a cost to manufacturers, who now face heightened pressure on high-revenue products.

These anticipated losses emphasize the IRA’s effectiveness in realigning financial responsibility, shifting more of the cost burden away from Medicare and its beneficiaries and onto drug manufacturers, particularly those with high-revenue, high-utilization therapies.

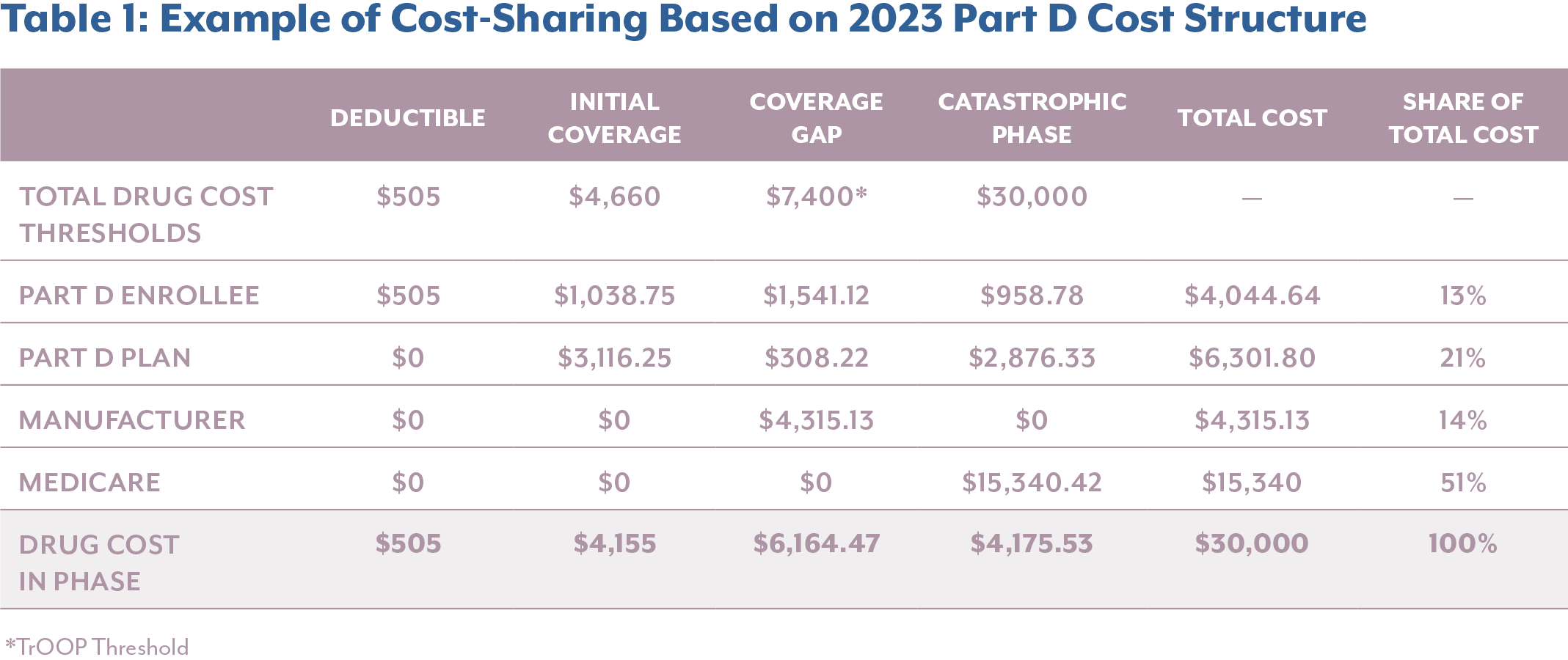

When breaking down the financial impact, it becomes clear that manufacturers are incurring significantly higher costs, particularly for high-cost specialty drugs that accumulate most of their costs in the catastrophic phase. In the example below, comparing the annual cost sharing breakdown of a $30,000 drug pre- and post-IRA, it reveals that the elimination of the Coverage Gap results in a shift of cost burden into the Catastrophic Phase, where manufacturers now face direct liability.

Comparing cost-sharing before and after the implementation of the IRA, manufacturer liability increases by $968 or 22.4% for this high-list-price product. Meanwhile, Medicare beneficiaries and the federal government see substantial savings, with enrollee out-of-pocket costs decreasing by 50.5% and Medicare’s share dropping by 69.4%. This example highlights how the IRA’s structural reforms are meeting their policy objective of reducing financial burden on patients and the government by reallocating it to manufacturers, particularly for drugs that have a high expenditure.

In parallel, the IRA expands the financial exposure for manufacturers by increasing the number of eligible beneficiaries in the catastrophic phase. The IRA raises low-income subsidy (LIS) eligibility from 135% to 150% and eliminates CGDP, where LIS beneficiaries were exempt from manufacturer discounts. To put this in perspective, in 2024, over 4 million individuals were enrolled in the Part D Coverage LIS program6, meaning manufacturers must now provide discounts for a significantly larger pool of patients. These changes not only increase financial liability but also require manufacturers to enhance their systems to identify LIS-eligible members, adjust rebate validation logic, and maintain compliance in a more complex and data-driven environment.

Who truly benefits?

As illustrated in the example above, drug manufacturers and Part D plans are bearing a greater share of costs due to the IRA provisions, however it is important to consider unintended consequences that may not have been fully addressed by CMS. Primarily, the increased financial burden on Part D plans, particularly for high-cost drugs, may create upward pressure on premiums, as these drugs often require a larger contribution from plans in the initial coverage. Ultimately, these costs may be passed back to enrollees, rolling back the financial protections the IRA was designed to provide and returning some patients to pre-IRA cost levels.

In addition, manufacturers are now financially responsible in two out of the three coverage phases. This means their liability continues indefinitely once a beneficiary meets the deductible. Before the IRA, a manufacturer’s 70% liability under the Coverage Gap ended when an enrollee’s TrOOP reached $7,400 and entered the catastrophic phase. Under the new structure, the financial liability becomes an ongoing financial liability, posing risks for manufacturer’s therapy portfolio.

To mitigate revenue loss, pharmaceutical companies may pursue actions such as removing certain drugs from Part D formularies or shifting R&D investment away from high-cost therapies toward lower-list-price products. If such responses become widespread, access to innovative medicines could be diminished, driving an unintended consequence of the Part D redesign.

Furthermore, for products subject to Maximum Fair Price (MFP) negotiations that are also eligible for Part D discounts, manufacturers are exempt from paying the MDP obligations. These costs are instead absorbed by CMS, potentially increasing the government’s financial burden.

Taken together, these dynamics may ultimately undermine the goals of the IRA’s Part D Improvements. Patients could face higher premiums and reduced access to therapies, while the government takes on greater financial responsibility, which are outcomes that the IRA aimed to prevent.

Phase-In Discounts

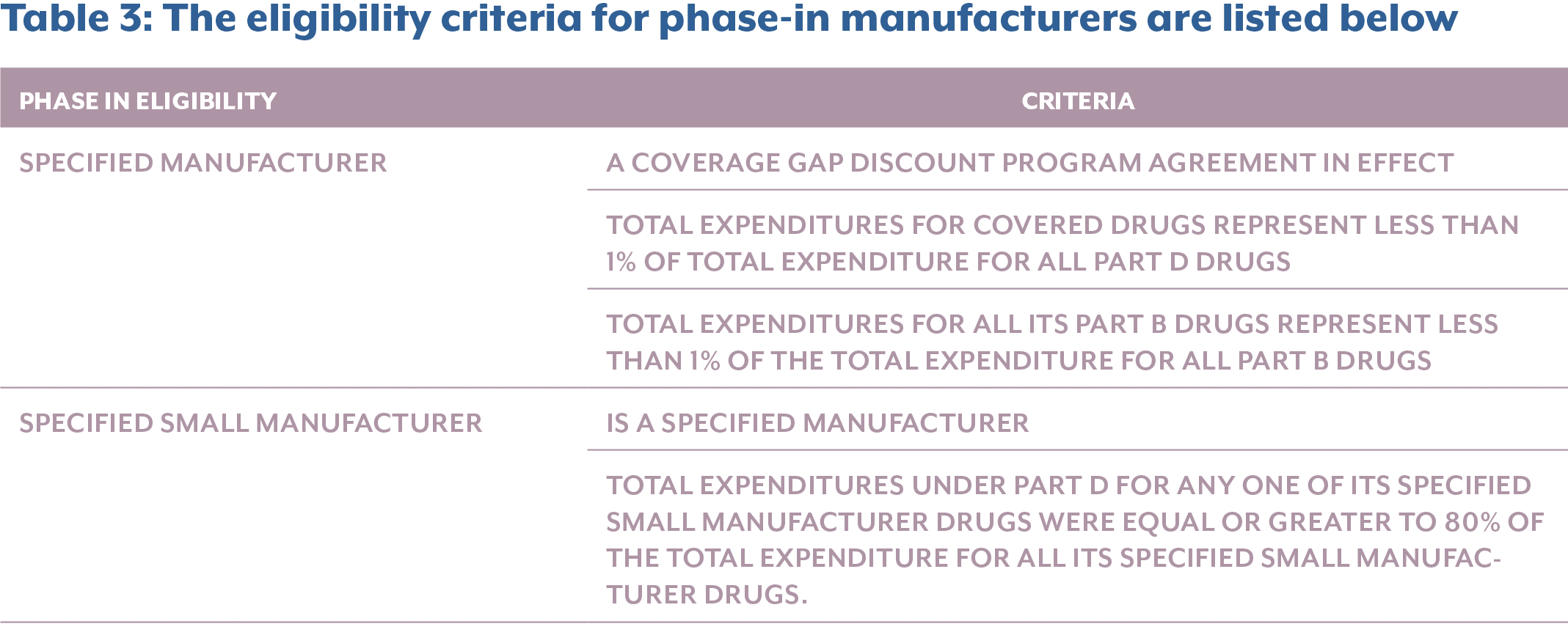

On the theme of perceived financial alleviation, the IRA allows for applicable manufacturers to apply their discounts through a multi-year phase-in period, which ends in 2031. There are two types of ways a manufacturer can be eligible for phase-in discounts:

- For certain applicable drugs from specified manufacturers dispensed to applicable beneficiaries who are eligible for Low-Income Subsidies (LIS).

- For certain applicable drugs from specified manufacturers and specified small manufacturers dispensed to all beneficiaries.

While the phase-in discounts under the IRA provide some short-term relief, they also introduce operational complexities for eligible manufacturers that differ significantly from their non-eligible peers.

For these manufacturers, financial planning becomes non-linear and increasingly difficult to forecast. Companies must adjust from 1% discount to a 20% discount over just five years, a trajectory that can have significant implications for budgeting and forecasting. One major risk is the potential to overestimate profitability during the early years. The initial low discount may create a false sense of financial stability, only to be offset by rapid revenue erosion as higher discounts phase in over time.

To manage this evolving liability, phase-in manufacturers must re-forecast their gross-to-net (GTN) calculations annually, adapting not only to increasing discount rates but also to shifts in product volume and utilization that may be driven by the discounts themselves. This creates added strain on multi-year financial planning, particularly for smaller companies that depend heavily on one or two blockbuster products. These companies must also account for overlapping lifecycle events such as Loss of Exclusivity (LOE), which, if occurring during the six-year phase-in period, could sharply accelerate revenue decline in parallel to increasing discounts.

From a market access standpoint, products under phase-in treatment may also face disadvantages. Plans may view them as less cost-effective relative to non-eligible drugs that offer higher immediate rebates. As a result, phase-in products may be deprioritized on formularies, potentially leading to access challenges for patients.

Furthermore, manufacturers near the 1% Medicare spend threshold face additional strategic uncertainty. An increase in Medicare utilization or drug pricing could tip them over the eligibility line, triggering full discount obligations, potentially retroactively or within the following year. This is especially risky for newly launched or rapidly growing products, which must be simulated based on varying eligibility and pricing scenarios. These companies will need to implement rigorous monitoring and forecasting to account for the potential shift in phase-in status as their Medicare market share expands.

The careful monitoring and forecasting due to Phase-In discount introduce operational changes that must be considered for eligible manufacturers, which are outlined in the section below.

Operational Implications

Operationally, manufacturers eligible for Phase-In discounts must implement and manage system logic able to apply and reverse phase-in discounts accurately, over short period of time, which can be disproportionately burdensome for smaller manufacturers.

To operationalize the phase-in mechanism, companies may need to update contracts, reconfigure pricing systems, and revise validation workflows annually. Each of these steps introduces operational risk, especially if an error occurs in applying the correct discount rate at the right time. For manufacturers relying on revenue management systems, additional complexities arise, where system customizations and technical upgrades may be necessary to accommodate the phase-in logic, often requiring renegotiation of service agreements, incurring additional costs, and increasing time management challenges.

While we have addressed some of the financial and operational implications for introduced by the phase-in discounts, it is important to recognize the operational impact the Part D redesign will have on all manufacturers. As with any major policy shift, successful implementation relies on strong cross-functional collaboration to ensure alignment with both CMS guidelines and Part D sponsor expectations.

As of May of this year, manufacturers and Plan D Sponsors should have received their Q1 2025 MDP invoices. Manufacturers are required to make payments within 38 calendar days from the date reported via the Third-Party Administrators (TPA) portal. Given their expanded liability across both the initial and catastrophic phases, the volume of invoices is expected to rise while payment timelines remain fixed. This can result in delays in processing, which typically lead to accrued interest. More importantly, repeated late payments could damage a manufacturer’s standing in federal programs, potentially jeopardizing participation in the MDP. This is further complicated by the decommissioning of CGDP systems and the ongoing set-up of new MDP infrastructure. As companies develop new capabilities, they must also account for processing lag and execution risk during this transition.

Although manufacturers are granted 60 days to dispute claims, the process design introduces additional risk. Payments must be made within the 38-day window, even before claims are fully scrubbed and validated. Only after payment can a manufacturer initiate a dispute for inaccurate claims. This “pay and chase” model imposes a significant administrative and financial burden, requiring companies to front large sums without assurance of claim accuracy. This model introduces cash flow volatility and poses challenges for GTN forecasting and accrual planning.

The burden is further magnified by the fact that manufacturers do not generate claims but are responsible for identifying and rectifying any inaccuracies. This creates a fundamental misalignment of accountability, as there are no consequences for dispensing entities that submit incorrect data, yet manufacturers bear the financial consequences. As stakeholders across the ecosystem adjust to new eligibility rules and coverage phases, the probability of inaccurate claims may increase, further exacerbating manufacturer risk exposure.

As IRA sunsets the CGDP and terminates all CGDP Agreements as of January 1st, 2025, manufacturers must prepare for several operational transitions. While manufacturers’ no longer face liabilities under CGDP for drugs dispensed after December 31st, 2024, invoicing activities will continue through January 31, 2028, to allow for prescription drug event (PDE) submissions to run-out, with final CGDP invoices excepted by April 30th, 2028. Manufacturers will have to manage two processes: the retroactive CGDP claims for drugs dispensed before 2025 and the real-time discount adjustments for drugs dispensed from 2025, under MDP.

To support this transition, the Manufacturer Payment Portal (MPP) has replaced the legacy CGDP Portal. The MPP will now manage invoice distribution, discount payment for manufacturers and report retrievals. to manage payments for the two processes, the new Manufacturer Payment Portal replaces the previous CGDP Portal and is used for the MDP. With the significant platform change, manufacturers should reassess their operational workflows to ensure uninterrupted CGDP invoice management though 2028, while standing up MDP operations, including clearly defined workstreams with dedicated ownership for MDP operations.

Adding to this complexity is the addition of new CMS-required data elements on MDP invoices. These expanded data fields will require enhanced reconciliation capabilities and increase the need for robust data infrastructure to manage compliance and audits.

The inclusion of new data elements on invoices under the MDP introduces additional accounting and operational complexities for manufacturers. To validate claims and reconcile invoices accurately, manufacturers must now track and correctly assign gross drug costs to the right coverage phase: 10% in the initial drug phase (GDCB) and 20% in the catastrophic coverage (GDCA). Manufacturers must be careful to classify the drug costs correctly as this may cause over or under payment, triggering disputes and penalties.

Navigating the IRA Through Technology

The enactment of the IRA introduces a range of challenges for manufacturers, creating complexities across people, processes, systems, and data. To operationalize these changes, technology becomes a critical enabler. As new beneficiaries, data elements, and discount liabilities are introduced under Part D, manufacturers will need robust systems that can integrate this information and automate processes such as invoice validation and dispute resolution to reduce errors and administrative burden.

Beyond the Part D Redesign, the MFP and the Inflation Rebates under the IRA introduce additional layers of operational complexity. In our ongoing “Navigating the IRA” series, we have published papers that highlight the key policy and operational impacts of MFP and inflation rebate provisions, with a focus on how technology can support compliance, data accuracy, and scalable workflows.

As the IRA continues to reshape pharmaceutical operations, we will be expanding this series to explore system integration strategies, system improvements and technology opportunities that can enable manufacturers to meet these evolving demands.

Conclusion

The Part D Redesign of the IRA represents one of the most significant changes to Part D coverage since its inception. While the redesign achieves its goal of reducing the financial burden of prescription drugs for beneficiaries and curbing government spending, it also introduces operational, financial, and strategic complexities for drug manufacturers. A robust, cross-functional approach is essential for integrating new ways of working into companies. Manufacturers must prepare by implementing processes that are agile, comprehensive, and proactive. The IRA offers drugmakers an opportunity to innovate their market access strategies, refine forecasting models, and scale up technology to differentiate themselves in the market.

Sources

- The Medicare Prescription Drug Program (Part D) Status Report, medpac.gov, https://www.medpac.gov/wp-content/uploads/2024/03/Mar24_Ch11_MedPAC_Report_To_Congress_SEC.pdf

- Final CY 2025 Part D Redesign Program Instructions Fact Sheet, CMS-gov, https://www.cms.gov/newsroom/fact-sheets/final-cy-2025-part-d-redesign-program-instructions-fact-sheet

- 3. Medicare Part D Prescription Drug Benefit, Congress.gov,

https://www.congress.gov/crs-product/R40611 - Final CY 2026 Part D Redesign Program Instructions Fact Sheet, CMS-gov, https://www.cms.gov/newsroom/fact-sheets/final-cy-2026-part-d-redesign-program-instructions

- A Spotlight on IRA Part D Redesign and its Impact in 2025, Pfizer.

https://investors.pfizer.com/investors/Events–Presentations/event-de-

tails/2025/Pfizer-Pflash - 2024 Low Income Subsidy Contract Enrollment by County, CMS.gov,

https://www.cms.gov/data-research/statistics-trends-and-reports/

medicare-advantagepart-d-contract-and-enrollment-data/lis-con-

tract-enrollment-county/2024-low-income-subsidy-contract-enroll-

ment-county - Revised Medicare Part D Manufacturer Discount Program Final Guidance, CMS.gov, https://www.congress.gov/crs-product/R40611

- Variables Definitions ,CMS.gov,

https://bluebutton.cms.gov/resources/variables